|

|

|

About SFOpenBook - Budget

Table of Contents

What is SFOpenBook?

SFOpenBook is the City and County of San Francisco’s transparency

website, providing residents, journalists and others with

interactive tools to understand City financial, economic and

government performance data. To learn more about the other parts of

this website, such as our Economic and Government Performance

Barometers and actual Spending and Revenue reporting, view the Frequently Asked Questions about SFOpenBook.

What does the City's budget consist of?

The City and County of San Francisco's budget is a two-year plan for

how the City government will spend money with available resources. In

the budget process, a budget is proposed by the Mayor, and then

modified and approved by the Board of Supervisors as the Appropriation

Ordinance. Each year, the City will update the Budget for the upcoming

fiscal year and also set a budget for the subsequent fiscal year, which

will be updated and approved in the following year. Enterprise departments do not submit a budget for the second year of the two year

budget; rather, estimates of enterprise department budgets in the

second year of the budget are incorporated into high-level spending and

revenue figures. For more on how the City's

budget is created, visit the resources on Frequently Asked Questions about SFOpenBook.

What is SFOpenBook - Budget?

The SFOpenBook - Budget tool is a searchable, user-friendly public site that allows you

to browse current and previous budgets at various levels of detail. Here, you can

find information about budgeted spending on salaries, benefits,

goods and services, budgeted revenues from taxes, fees and other

sources, as well as budgeted staffing levels, represented by the number of Full Time Equivalents (FTEs).

What information can I find here?

As you navigate through SFOpenBook - Budget, you will find budgeted spending and revenues by Organization, Type, and Fund; staffing (FTE) can also be displayed by Job.

By clicking on an item, you can drill down to discover more detail. By

changing filters, you may choose to view budgeted spending, revenue or staffing (FTE), and show either one year or five years of data at a time. For

example, on this site you can browse for a department and see how the

department’s budget has changed over five years. View examples of what you can learn on this site.

What is the difference between SFOpenBook's Budget and Spending & Revenue tools?

- The Budget tool shows planned spending and revenue estimates that were

developed at the beginning of each fiscal year. The Spending &

Revenue tool shows spending and revenue activity as it actually

occurred. Because not all spending will be budgeted at the beginning of

the year, figures in the Budget tool may not be directly comparable to

figures in the Spending & Revenue tool. For example,

additional funding for some major capital projects will be approved through a supplemental

budget process.

- In government accounting, "unappropriated fund balances" are available amounts that have not yet been appropriated, or designated to be spent for a specific purpose by the Board of Supervisors.

- Money collected in one year may not spent until several years later. It would be in the fund balance for multiple years. If the full fund balance was shown in each year of a five year comparison, it would be counted multiple times. For this reason, fund balances are not shown in SFOpenBook - Spending and Revenue.

- Part of a fund balance may be used in the budget (appropriation ordinance) to fund spending. In cases like this, SFOpenBook - Budget, as in the Appropriation Ordinance, will show the use of fund balance as a revenue (sources of funds) for the year in which it is being used. Since it is an estimate of what will be used in one year there is no risk of double counting when comparing budgets over several years.

- Spending and revenue data for some fiduciary funds and component units are

available in SFOpenBook- Spending & Revenue, but not

in SFOpenBook - Budget. These funds are not present in the City's

budget because the Board of Supervisors does not approve budgets for these items. For

example, the value of pension payments made directly to retirees is not

present in

SFOpenBook - Budget, but can be seen in SFOpenBook - Spending &

Revenue when the Related Gov't Units filter is set to "Include". The

specific funds and component units not present is SFOpenBook - Budget

are:

- Fiduciary Funds

- Agency (7A) [Superior Court funds]

- Successor Agency-Former SF Redev Agency (7S)

- Component Units

- SF Redevelopment Agency (8R)

- Treasure Island Development Authority (8A)

Where does this data come from, and how does it differ from other sources?

This data is a summary of budget data published in the City and County's appropriation ordinances. Some data may be shown differently here compared to other City reports. These differences can be summarized as follows:

- In some other reports the money a department receives from another department as payment for services provided (a workorder) is reported as negative spending. In SFOpenBook, as in the Appropriation Ordinance, these 'recoveries' are recorded as positive revenues.

- The staffing (FTE) data in SFOpenBook - Budget is

sourced from the Appropriation Ordinance, which includes

positions that are being funded in the appropriation ordinance. These figures do not

necessarily match the number of FTEs in the Annual Salary Ordinance

(ASO). The Salary Ordinance contains the number of authorized positions, some of which

may not be funded in the appropriation ordinance.

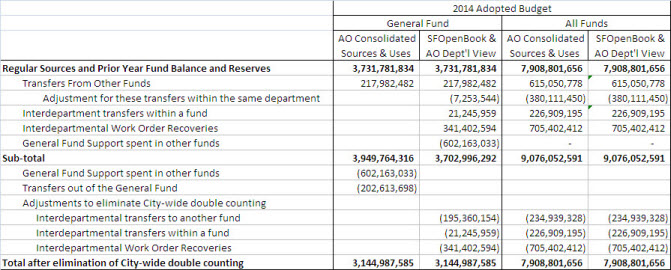

- The Gross Total in SFOpenBook for the General Fund and the General Fund amount shown in the Consolidated Schedule of Sources and Uses in the Appropriation Ordinance cannot be compared and are numbers that answer different questions.

- To answer the question "How much does the City and County take in and pay out?" the consolidated schedule takes the following approach to showing General Fund (GF) activity:

Regular revenues and fund balance & reserves

+ Tranfers in

= Amount available for use in the GF (Gross)

- Transfers out

= Amount ultimately spent from the GF (Net)

- The SFOpenBook and Appropriation Ordinance departmental views answer the question "How much does each department spend?". To show how much is spent by departments from the General Fund we make the following adjustments to the regular revenues and fund balance & reserves:

+ Transfers from one department to another (leaving out transfers within the same department)

+ Recoveries from one department to another (leaving out recoveries within the same department)

- GF spent in other funds (this is deducted from GF Sources and added to the other fund's Sources)

This is the SFOpenBook gross total. By removing the transfers and recoveries that go from one department to the another we see the same net total that is in the Appropriation Ordinance Consolidated Schedule of Sources and Uses.

Note that the amount added for transfers into the General Fund that move from one department to another (shown in the example table as transfers into the General Fund less the adjustment for these transfers that go in and out of the same department) is different than the amount deducted to eliminate the double counting caused by transfers.

- You can read more about Transfer Adjustments in the glossary to learn how we eliminate double counting by deducting transfer amounts from both the source and use sides of the fund and department where the transfer out is budgeted. Because spending is controlled to ensure that no more is spent than has been received as revenue, the perspective of the Net total is to identify the fund and department that ultimately spend the money.

- The view of budget data here differs from the one used in the

City’s year-end financial statements to meet Generally Accepted

Accounting Principles (GAAP). For example, SFOpenBook

shows budgeted spending on capital improvements in the year they are

planned to occur, while the financial statements spread actual spending

over the life of the capital asset using the technique known as

"depreciation." Please refer to the City’s Comprehensive Annual Financial Report (CAFR) for the City’s year-end financial statements.

What information will I not find here?

- Because departments generally do not budget Revenues by

Program, SFOpenBook - Budget does not show Revenue figures at the

Program level. For instance, if you click the department Human Services

while viewing Revenues, SFOpenBook does not show revenues for Human

Services' by program. For more detail on a department's revenue

sources, click the "Type" tab in SFOpenBook - Budget.

- The City’s budget system does not identify maintenance

costs by geographic location. For example, in SFOpenBook you will not

be able to find how much money the City plans to spend maintaining a

specific park, such as Alamo Square.

- Sub-objects are the most detailed Type

data available in SFOpen Book - Budget. For instance, under the Object

"Equipment Purchases," there is no additional information on the

Sub-object "Automotive & Other Vehicles." For actual spending, you

can go to the SFOpenBook Spending and Revenue tool to see actual payments by vendor and document for more detail on this sub-object.

How often is the website updated?

SFOpenBook - Budget is updated twice each year: in early June when the

Mayor's Proposed Budget is released, and in July when the Board of

Supervisors passes the Appropriation Ordinance. The site does not

include mid-year Revised Budgets, supplemental appropriations, or other

modifications to the budget that occur throughout the year. Note that

after a budget is approved, the second year of the budget will be

updated the following year.

Are amounts from previous years adjusted for inflation?

No. For instance, budget figures for spending in Fiscal Year 2009-2010

represent the value of the dollar in that fiscal year. In economic terms,

these are "nominal" values.

|

|

|