|

|

|

Glossary

Table of Contents

Tabs:

Filters:

Data Table:

Other Terms

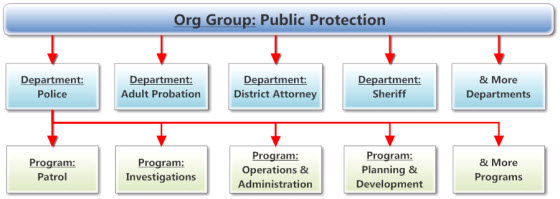

Organization - This tab shows three levels of detail

(Org Group, Department and Program) that classify spending and revenue

activity by organizational unit. Each Org Group consists of one or more

Departments, and each Department consists of several Programs. The

chart below shows the hierarchy of the Organization tab through the

example of the Org Group Public Protection and the Police Department.

Organization Group - In the Organization tab, Org

Group is the highest level of detail, and generally represents a group

of Departments. For example, the Public Protection Org Group includes

Departments such as the Police Department, Adult Probation, the

District Attorney, and the Sheriff.

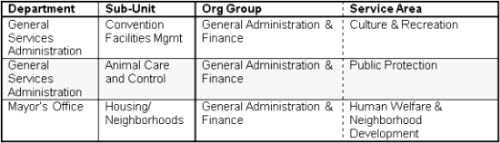

Note that Org Groups are similar to - but in a few cases

different than - Major Service Areas (MSAs) that are used in the City

and County’s year-end financial statements (Consolidated Annual

Financial Report, or CAFR). As shown in the table below, sub-units of

two departments are reported in different Major Service Areas, but

belong to one Organization Group.

Department - In the Organization tab, Department is

the middle level of detail. Departments are the primary organizational

unit used by the City and County of San Francisco. Examples of

Departments are Recreation and Parks, Public Works, and the Police

Department. See the Department List for a complete list of departments.

Program - In the Organization tab, Program is the

lowest level of detail. A program identifies the services departments

provide. For example, the Police Department has programs for Patrol,

Investigations, and Administration. Because departments generally do not budget Revenues by Program, SFOpenBook - Budget does not show Revenue figures at the Program level.

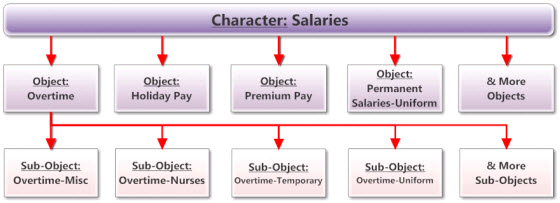

Type - This tab shows three levels of detail

(Character, Object and Sub-object) that group spending and revenue

activity by type. For example, spending on office supplies throughout

the City is identified using a sub-object. Each Character consists of

several Objects, and each Object consists of several Sub-Objects. The

chart below shows the hierarchy of the Type tab through the example of

the Salaries Character and the Overtime Object.

Character - In the Type tab, Character is the highest

level of detail for type of activity. For example, salaries, benefits,

contractual services, and materials & supplies are recorded as

different Characters.

Object - In the Type tab, Object is the middle level

of detail for type of activity. For example, within the Salaries

Character, Objects differentiate between Permanent Salaries, Temporary

Salaries, and Overtime pay.

Sub-object - In the Type tab, Sub-object is the lowest

level of detail for type of activity. For instance, within the Overtime

Object, Sub-object segregates overtime for nurses from overtime for

police officers and fire fighters (known as uniformed staff).

Sub-objects are the lowest level of Type data available in SFOpenBook

Spending and Revenue. For instance, under the Equipment Purchases

Object, there is no additional information on the Automotive &

Other Vehicles Sub-object, so you will not be able to identify what

cars were purchased and for what amount. However, you can use Vendor Payment Summaries to get detail by vendor and document.

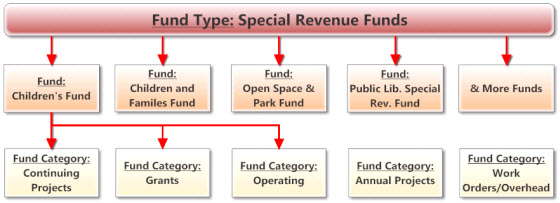

Fund - This tab shows three levels of detail (Fund

Type, Fund, and Fund Category) for how the City segregates pots of

money for particular uses into fund accounts. For instance, the General

Fund is used for many purposes, while the General Hospital Medical

Center Funds are used only for spending related to San Francisco

General Hospital. The use of funds is governed by law and/or accounting

standards.

Fund Type - In the Fund tab, Fund Type is the highest

level of detail for fund accounts, and is used to group Funds according

to governmental accounting standards.

Fund - In the Fund tab, Fund is the middle level of

detail for fund accounts. For example, within the Special Revenue Fund

Type, you can find the Children's Fund and the Open Space & Park

Fund.

Fund Category - In the Fund tab, Fund Category is the

lowest level of detail for fund accounts. Within Fund, Fund Categories

group activity by their characteristics: Operating, Annual Projects,

Continuing Projects, Grants, Interdepartmental/Work Order.

A note about the annual and continuing fund categories:

Unspent money that was budgeted for annual projects is returned to fund

balance at the end of the fiscal year; those funds must be appropriated

(budgeted) in the following year before they can be used. Unspent money

budgeted for continuing projects remains dedicated and available for

the original purpose across fiscal years.

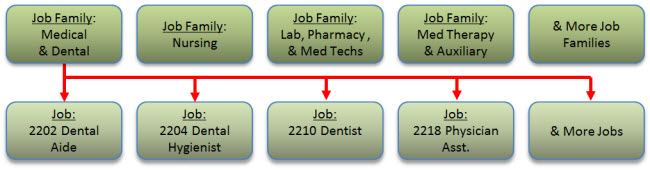

Job - This tab shows two levels of detail (Job Family and Job) when the report type Staffing (FTE) is selected.

Job Family - In the Job tab, Job Family is the highest

level of detail and is used to combine similar Jobs into meaningful groups.

The Job Family "Turnover Allowance/Adjustment" is used for special jobs that are only used in the budget. It includes:

- Attrition Savings: This is the allowance for turnover, an estimate of funding that will not be used because positions will not be filled all year.

- Estimated Project Funding: Positions used for capital and other projects are often not budgeted in the project but in an operating fund. This job is used for the estimate of funding that will come from projects.

- Positions Not Detailed: This is used for adjustments that cannot be included in the budget in any other way.

- Temporary Positions: Positions needed for less than six months often cannot be anticipated during the budget process and use this special job.

Job - In the Job tab, Job is the

lowest level of detail. Within Job Family, Jobs are defined by the Human Resources classification unit. Examples include gardeners, police officers, and accountants.

Fiscal Year (FY) - An accounting period of 12 months.

The City and County of San Francisco operates on a fiscal year that

begins on July 1 and ends on June 30 the following year. The Fiscal

Year ending June 30, 2012 is represented as FY2011-2012.

Revenue - Money received in the a fiscal year or

reserved from a prior year. For example, when the City receives money

from taxes, this is revenue. The strict accounting definition of this

money would be "Sources."

Spending - Money spent in the a period or reserved for

use in a future period. For example, when the City buys office

supplies, this is spending. The strict accounting definition of this

money would be "Uses."

Staffing (FTE) -

Staffing level is represented by "Full Time Equivalent (FTE)". One FTE equals one or more employees

who together work 40 hours per week. For instance, an employee who

works 40 hours per week is counted as one FTE in the City's budget,

and two part-time employees who each work 20 hours per week are

also counted as one FTE. Overtime hours are excluded from this calculation. FTE is relative to the time period.

FTEs in the budget are based on 2080 hours per year. FTE is calculated by dividing hours worked by the normal hours per year,

and totals may not sum due to rounding.

Transfer Adjustments - Amounts that eliminate double counting of activity that is recorded twice in the City's budget system.

Transfer Adjustments (Basic Explanation)

To meet accounting needs, money can be moved from one fund or

department to another. For example, Public Works provides building

maintenance services for the Fire Department for which the Fire

Department pays Public Works.

-

Fire gets a variety of revenue, some of which it spends for Services of Other Depts

- Public Works gets revenue in the Expenditure Recovery

Character which it spends on Salaries, Benefits and Contractual

Services to provide the building maintenance services

- The table below shows that the $100,000 of spending &

revenue for this activity would be double counted when looking at the

total City and County budget.

To solve this double counting problem, SFOpenBook shows a reduction

of $100,000 called Transfer Adjustments (Citywide) to the budgeted

spending & revenue for the department providing the service. This

lets SFOpenBook display both the gross total of activity for both

departments and the net total use of City and County revenues.

Transfer Adjustments (Citywide)

In the example above, the money is moving both between departments,

from Fire to Public Works, and between funds, from General Fund

Operating to General Fund Works Orders/Overhead.

- Transfer Adjustments (Citywide) are used when money is moved from

one department to another. These are deducted from the gross total to

create the net total.

- Transfer Adjustments are included in the gross total when

they are within the same department. A separate sub-object is used to

distinguish departmental Transfer Adjustments from Transfer Adjustments

(Citywide).

- Transfer

Adjustments (Citywide) in SFOpenBook - Budget may differ from transfer

adjustment lines in other public reports as a result of different

approaches used to report transfers; however, the net total will remain

the same across SFOpenBook - Budget, the Mayor's Budget Book, and the

Appropriations Ordinance, with limited exceptions due to error

corrections and different methodologies used to present net totals. For

more information, contact us.

Transfer Adjustments (within the same department)

An example of a Transfer Adjustment within a department would be

Public Works overhead allocations. Overhead costs cannot easily be

isolated to a direct service or unit and so are allocated across those

units using accepted accounting methods. Central management costs are

allocated to the different parts of Public Works (e.g. Building Repair,

Urban Forestry, Construction Management).

$100,000 of activity is double counted within the department.

In this case, the Transfer Adjustments are shown in the Gross Total since the double counting is within one department.

Transfer Adjustments (for Revenue Transfers)

The examples above involved Expenditure Recovery; the other kind of

activity that requires Transfer Adjustments involves Revenue Transfers.

-

Revenue Transfers move revenue from one fund to another as required by governmental accounting standards.

-

Transfer Adjustments for Revenue Transfers work much like those for Expenditure Recovery.

-

They are recorded with a Revenue Transfer Out and a Revenue Transfer In

Character (in the Type hierarchy) instead of using Services of Other

Departments and Expenditure Recovery.

-

They can be within the same department or they can be between different departments.

- The Transfer Adjustment is shown in the fund with the Revenue

Transfer Out as shown in the following example of a transfer from Fund

A to Fund B.

Gross Total - The total amount of spending or revenue,

including some activity that is double counted because it is recorded

in two departments to support departmental accounting needs. See Transfer Adjustments for a more detailed explanation of this.

Net Total - The total after Transfer Adjustments

(Citywide) is removed from the Gross Total to eliminate double counting

when money is moved from one department to another. See Transfer Adjustments for a more detailed explanation of this.

Enterprise Department

- Departments that charge customers for services and in many ways operate like a business such as the Airport, Port, and Public Utilities Commission. These departments do not submit a two-year

budget, but rather a budget for the first year of the two-year budget

cycle and a high-level estimate for the following year. The second year

estimate is incorporated into high-level Citywide spending and

revenue figures, but not shown in detail at the department level. The

City's

enterprise departments are:

- Airport

- Board of Appeals

- Environment

- Municipal Transportation Agency

- Port

- Public Utilities Commission

- Rent Arbitration Board

Transfer (Revenue Transfer) - Money transferred from

one fund to another. This is recorded using a Revenue Transfer Out

Spending Character and a Revenue Transfer In Revenue Character (in the

Type hierarchy). Revenue transfers between funds can be within the same

department, or from one department to another.

Vendor - A company or individual that the City pays in return for goods or services. Use the SFOpenBook Vendor Payment Summaries to view activity by vendor and document.

Work Order - Money one department pays to another

department for services received. For example, the San Francisco Public

Utilities Commission (PUC) pays the Department of Public Works for

construction services on new sewer lines using a Work Order. Work

Orders can be identified in the Type hierarchy; they use the Services

of Other Departments Spending Character and the Expenditure Recovery

Revenue Character.

|

|

|